Umm al Quwain, one of the UAE’s captivating emirates, is not just a treasure trove of cultural heritage and breathtaking landscapes; it’s also a vibrant hub for commerce and automotive pursuits. In this emirate, understanding the dynamics of tire sales and pricing is a crucial factor in comprehending the automotive market’s pulse.

The Importance of Pricing Analysis

Before diving into the tire market, recognizing the significance of pricing research is fundamental. It’s a compass guiding businesses in calibrating their pricing strategies to elevate revenues and margins. This analysis delves into the current market prices, a critical gauge for businesses looking to thrive in Umm al Quwain’s tire market.

Market Overview

The tire industry in Umm al Quwain mirrors the dynamism of the automotive sector. Tires, an indispensable component for individual vehicles, business fleets, industrial machinery, and the burgeoning tourism sector, witness consistent demand. This demand stems from the region’s growth in population and economic expansion, driving the need for diverse tire options.

Key Players

Numerous local and international tire manufacturers and distributors operate in Umm Al Quwain, fostering a competitive landscape. From global giants to local retailers, an array of brands ensures consumers access a wide spectrum of choices, offering options suited to various needs.

Analyzing Brands and Market Dynamics

The competitive landscape boasts a plethora of 65 brands, ranging from premium to regional ones from China, Japan, and other countries. Amidst this variety, Bridgestone emerges as a dominant force, capturing over 10% of total sales across vehicle types and rim sizes from 14″ to 20″. This brand’s consistent performance amid diverse options underscores its popularity among consumers.

Impact of Regulations and Industry Sectors

Regulations mandating tire changes every five years from the manufacturing date significantly influence consumer behavior and drive tire replacement sales. Moreover, the industrial sector, hosting the majority of tire stores in Umm Al Quwain, accounts for a substantial 78% of overall tire sales. This concentration is a testament to the sector’s impact on sales distribution.

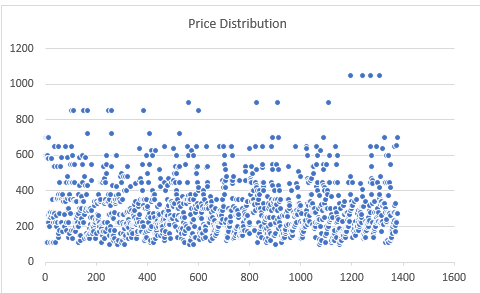

Pricing Analysis and Consumer Preferences

Examining pricing patterns reveals an average price range spanning from 120 AED to 1050 AED. The most sold Bridgestone tires averaged around 480 AED, showcasing stability in pricing over the past four months. Preferences for 16” radial tires emerged as the most popular, while 22” witnessed the least traction, with marginal price variations.

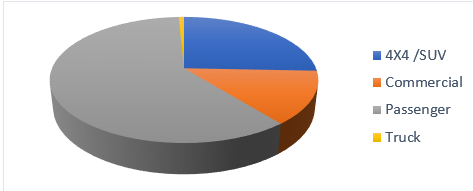

Sales Distribution by Vehicle Types

Passenger car tires hold the lion’s share at 60% of total sales, followed by 4×4/SUV tires at 26%, and light truck tires at 14%. Surprisingly, truck tires contribute merely 1% to the market, indicating a notable preference gap in Umm Al Quwain.

Understanding these intricate sales trends and preferences in Umm Al Quwain’s tire market is invaluable. Businesses can leverage these insights to refine inventory management, tailor marketing strategies, and align offerings with customer preferences. Simultaneously, consumers gain a clearer understanding of the market, aiding informed tire purchases. The evolving landscape presents opportunities for both businesses and consumers to navigate the tire market more astutely in Umm Al Quwain.

FAQ

Q1: What factors contribute to the dominance of Bridgestone tires in Umm Al Quwain’s market?

A: Bridgestone’s popularity is attributed to its versatile range, quality, and widespread availability across various vehicle types and rim sizes. Its consistent performance and brand reputation contribute to its dominance.

Q2: How often should car tires be replaced in Umm Al Quwain according to regulations?

A: As per UAE law, car tires should ideally be changed every five years from their manufacturing date, emphasizing safety and vehicle maintenance standards. However, individual tire longevity may vary based on usage and conditions.

Q3: What impact does the industrial sector have on tire sales in Umm Al Quwain?

A: The concentration of tire stores in industrial areas significantly influences sales, accounting for approximately 78% of overall tire sales. The proximity to businesses and commercial vehicles contributes to this sector’s impact.

Q4: What are the most preferred tire sizes and vehicle types in Umm Al Quwain’s market?

A: 16” radial tires are the most favored, while larger sizes, like 22” tires, witness lower demand. Passenger car tires dominate sales with a 60% share, followed by 4×4/SUV tires (26%) and light truck tires (14%).

Q5: How do tire prices vary in Umm Al Quwain, and what are the factors influencing this pricing?

A: Tire prices range from an average of 120 AED to 1050 AED. Variations depend on brand, tire size, and quality. Premium brands like Pirelli command higher prices, while mid-range brands like Bridgestone maintain a stable average price of around 480 AED.